Understanding Payment Card Security

February 11, 2026

Every day, customers trust your Ace Hardware store with something deeply personal — their payment card information. That trust is earned one transaction at a time, and protecting it is not just a compliance requirement; it’s a responsibility to your customers, employees, and the community you serve.

Payment card security is one of the most common – and most costly – areas of cyber risk for retail businesses. Fraud, chargebacks, regulatory penalties, and even the loss of card-processing privileges can all stem from a single breakdown at the point of sale.

To help Ace retailers reduce risk and stay aligned with the PCI Data Security Standard, DilSe.IT has developed updated Payment Card Security Guidelines (requires AceNet login) specifically for the Ace retail environment.

What Every Ace Store Should Be Doing Today

These guidelines focus on real-world, store-level practices that matter most:

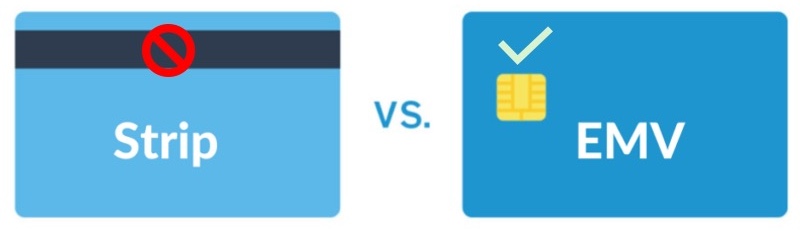

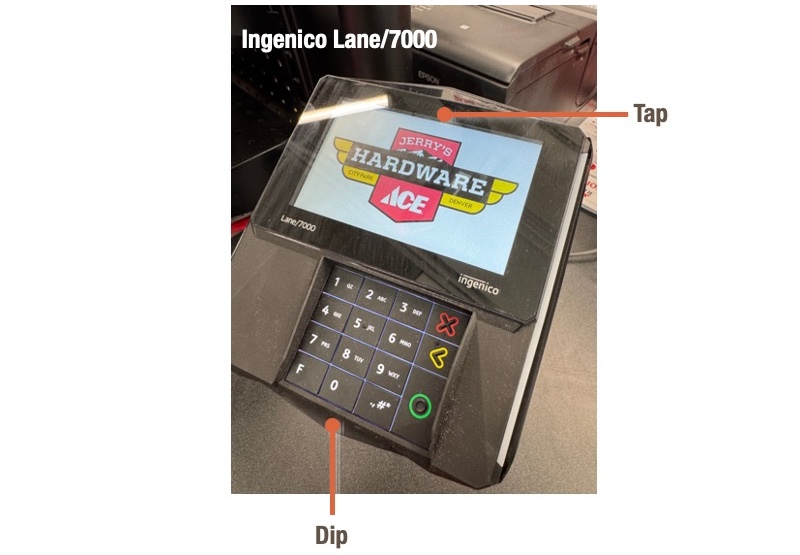

Use secure payment methods first.

EMV chip (“dip”) and contactless (“tap”) transactions generate one-time encrypted codes that dramatically reduce fraud risk and PCI compliance scope. Swipe and manual entry should be rare, controlled, and documented.

Avoid manual card entry whenever possible.

Manually keyed transactions bypass critical protections, carry higher fees, and shift fraud liability back to the retailer. If manual entry is allowed, it should require manager approval and additional verification.

Never write down or store card data.

Card numbers, expiration dates, and security codes (CVV/CVC/CID) must never be written, emailed, texted, photographed, or saved — even temporarily.

Inspect PIN pads daily.

Card skimmers are small, fast to install, and devastating when missed. Daily visual inspections help protect your customers and your brand.

Eliminate personal use of store technology.

Personal email, web browsing, USB devices, and phone charging on store computers introduce unnecessary risk and violate PCI expectations. Store-owned systems must be used for business purposes only.

Train employees to recognize suspicious behavior.

Repeated chip failures, requests to swipe a chip card, unusual cards, or pressure to “make an exception” are all reasons to pause and escalate to management.

Why This Matters

A payment card incident doesn’t just impact your store — it impacts your customers, your employees, neighboring businesses, and your reputation in the community. In many cases, the financial and operational damage far exceeds the original transaction.

Cybersecurity isn’t about fear — it’s about preparation, consistency, and good retail discipline. Learn more at our cybersecurity page on Ace Way of Retailing (requires AceNet login).