Cyber Risk Mitigation

October 4, 2025

Being PCI Compliant does not mean your business is secure. Checkbox compliance is not a substitute for real security. PCI establishes only the minimum standards for protecting sensitive customer information. To truly protect your business, you need clear policies, accountability, modern cybersecurity technologies, staff training, and meaningful cyber insurance coverage.

October is Cybersecurity Awareness Month. Each week in October, DilSe.IT will publish an article about cybersecurity for Ace Hardware stores and small businesses more broadly. We begin this series with one of the least understood topics in cybersecurity: cyber insurance.

Nearly half of small businesses still do not carry cyber insurance. And while many business liability insurance policies include some cyber coverage, it is usually inadequate for the risks businesses face today. In fact, studies show that 60% of businesses who have submitted a cyber claim discover they are underinsured.

Cyber insurance is designed to cover the wide-ranging costs of a cyberattack, including:

- Breach response: forensics, legal counsel, crisis communications

- Electronic theft: stolen funds, data, or digital assets

- PCI fines and assessments: investigations, penalties, and settlements

- Notification and credit monitoring: protecting affected customers

- Ransomware and extortion: ransom payments and recovery efforts

- Business interruption losses: income loss, payroll liabilities, rent, etc.

- Reputation management: PR and marketing to restore customer confidence

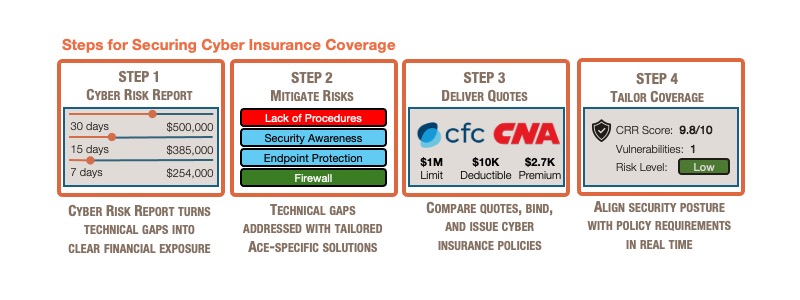

The average cyberattack costs a small business more than $25,000 — and major incidents can easily reach into the hundreds of thousands. Securing cyber insurance requires assessing your risks, evaluating carriers, and tailoring coverage to your business needs.

Your carrier becomes a partner in the event of an attack, offering access to specialists who help you respond and recover quickly. But insurance alone is not enough. Carriers often deny claims if required controls are missing. Insurance without proof of security measures is a false safety net.

That’s why you also need technical expertise from a trusted IT partner. You need documentation of security controls, evidence of staff training, and a culture of cybersecurity within your business. Stay tuned for additional articles addressing these topics during Cybersecurity Awareness Month.

Cyber insurance is a critical safety net, but it only works when combined with the right technology, training, and controls. Don’t wait until a cyber incident exposes the gaps in your protection. Partner with experts who understand retail and today’s cyber threats to evaluate risks, strengthen defenses, and secure the right coverage.